Prequalification vs. Preapproval vs. Conditional Approval: Understanding Mortgage Approval Stages in Texas

Understanding Mortgage Approval Stages in Texas

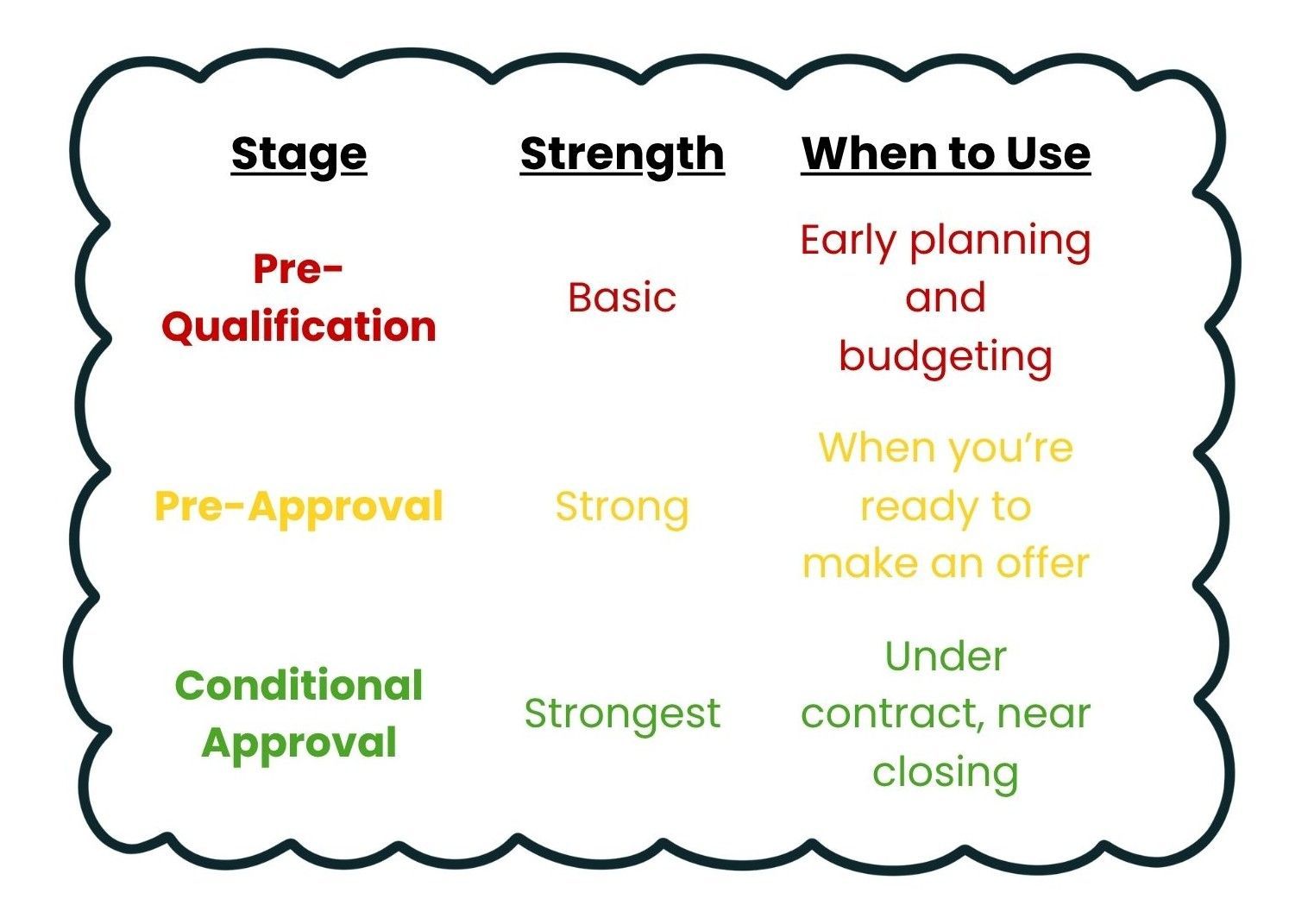

Buying a home in Texas—especially in competitive markets like Collin County—means being prepared long before you find your dream home. Understanding the difference between pre-qualification, pre-approval, and conditional approval can give you a serious advantage when you’re ready to make an offer.

Let’s break it down simply—and highlight what most buyers (and even some agents) overlook.

1. Pre-Qualification: Your Budget Snapshot

What it is:

Pre-qualification is the first step in the mortgage process. It’s an estimate of how much you may be able to borrow based on the financial information you share with a lender.

Key Features:

✔ Quick and easy—often done online or by phone

✔ Usually no hard credit check

✔ Based on unverified financial info

Why It Matters:

Pre-qualification helps you understand your estimated budget before you start touring homes. It’s perfect for early planning, but sellers don’t take it as proof of financing since income and employment aren’t verified.

Cindy’s Tip:

Use pre-qualification to explore affordability and monthly payments—but

don’t rely on it when making an offer. It’s a conversation starter, not a commitment.

2. Mortgage Pre-Approval: Your Stronger Offer Signal

What it is:

Pre-approval is the next step and carries more weight. Your lender verifies your credit, income, debts, and assets before issuing a letter showing what you’re qualified to borrow.

According to HAR.com, pre-approval is a “deeper financial review that provides proof you can secure a mortgage,” giving buyers a stronger negotiating position in Texas markets.

Key Features:

✔ Hard credit inquiry required

✔ Documentation needed: pay stubs, tax returns, bank statements

✔ Reflects verified financial data

Why It Matters:

In fast-moving areas like

Allen,

McKinney,

Plano, and

Frisco, a pre-approval letter shows sellers that your financing is secure and your offer is serious.

Pro Tip (Most Agents Miss):

Ask your lender how long the pre-approval is valid—typically 60-90 days—and how rate changes might impact your purchasing power. Also verify that your estimated payment includes local property tax rates and HOA dues, which vary widely across Collin County.

3. Conditional Approval: One Step from “Clear to Close”

What it is:

Conditional approval means your loan file has been reviewed by an underwriter and approved—pending a few final conditions. You’re nearly at the finish line.

Key Features:

✔ Issued by an underwriter, not just a loan officer

✔ Conditions may include updated statements, appraisal, or explanations

✔ Strongest financing position short of final approval

Why It Matters:

Conditional approval tells sellers your financing is 95% complete—just waiting for final checks. This can help you negotiate shorter closing times or stand out in multiple-offer situations.

Insider Tip:

Request your lender’s “conditions list” and follow up quickly. Many delays in Texas closings happen because a small documentation issue goes unresolved.

If you’re buying a home in Collin County, getting pre-approved—or better yet, conditionally approved—puts you ahead of the competition. It’s not just about knowing your numbers; it’s about showing sellers you’re a serious, qualified buyer.

Need a trusted local lender?

We work with experienced

mortgage professionals who understand Texas guidelines, local taxes, and neighborhood nuances to make your path to homeownership seamless.

📞 Call or text: (469) 499-7452

📧 Email: cindycoggins@kw.com

Sources:

- HAR.com. “Get Mortgage-Ready: Pre-Qualification vs. Pre-Approval.” Retrieved from https://www.har.com/blog_133046_why-january-is-the-best-time-to-buy-a-home

- Investopedia. “What Is a Conditional Mortgage Approval?” Retrieved from https://www.investopedia.com/terms/c/conditional-approval.asp

- Consumer Financial Protection Bureau (CFPB). “Steps to Get a Mortgage Preapproval.” Retrieved from https://www.consumerfinance.gov/owning-a-home/getting-a-mortgage-preapproval/