Little (or No) Money Down: Your Friendly Guide to Getting a Mortgage in North Texas 🏡✨

The Truth Behind the Myth

4 Most Common Loan Programs

1. FHA Loans –

Flexible and Accessible

Down payment: As low as 3.5%

Best for: Buyers with moderate credit or limited savings

Why it works: FHA loans are HUD-backed, offering easier qualification and competitive rates.

2. VA Loans –

Built for Service Members

Down payment: 0%

Who qualifies: Veterans, active-duty service members, and eligible spouses

Key benefit: No mortgage insurance and often lower interest rates.

3. USDA Loans –

Zero Down in Eligible Areas

Down payment: 0%

Best for: Homes in qualifying rural areas (including parts of Collin County)

Why it works: Competitive rates and flexible credit guidelines.

4. Conventional Loans –

Low Down, Strong Credit

Down payment: As low as 3% for first-time buyers

Best for: Buyers with good credit

Note: PMI applies until sufficient equity is reached.

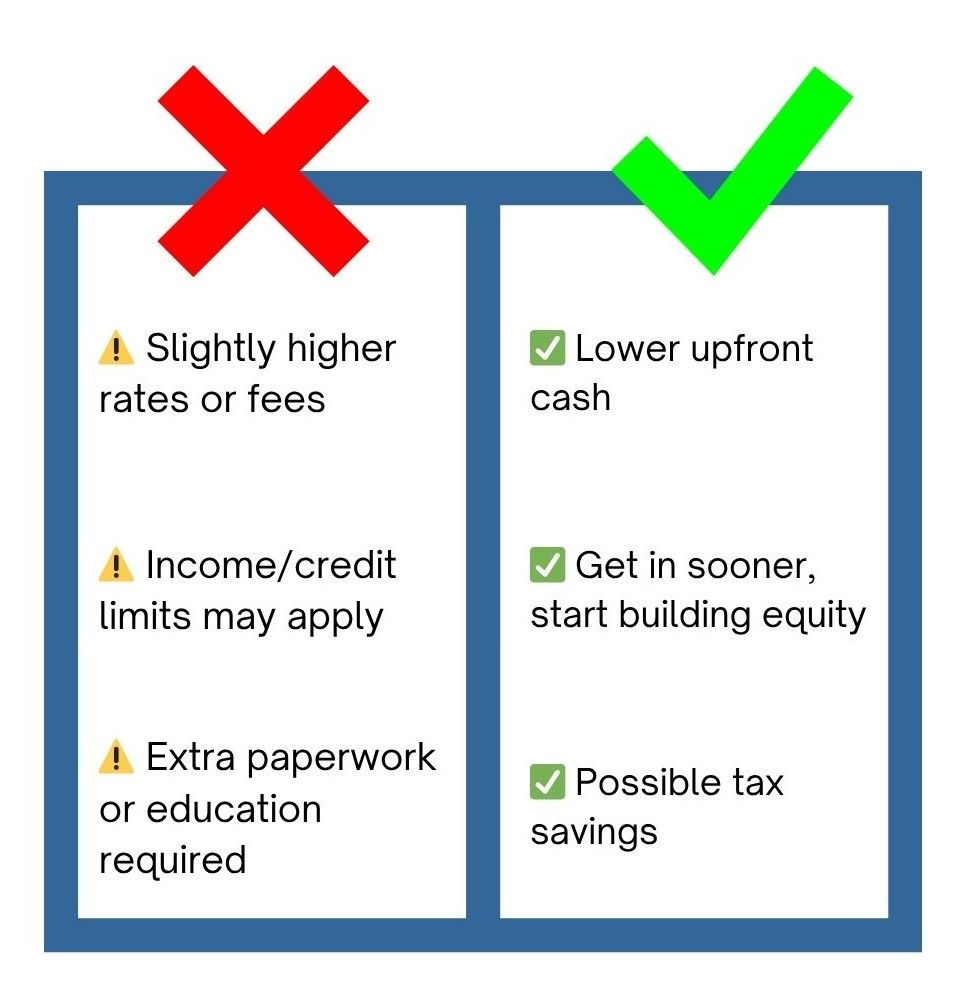

Down Payment Assistance: Free Help for Texans

If saving for a down payment feels out of reach, Texas offers practical options. Grants and forgivable second loans can help cover part—or even all—of your upfront costs.

One example is the TSAHC “Home Sweet Texas” program, which may provide:

- Up to 5% assistance toward down payment or closing costs

- Potential Mortgage Credit Certificates (MCCs) for ongoing tax savings

- Availability statewide for qualifying buyers

With the right program, buying a home doesn’t have to mean draining your savings.

“But Rates Feel High…” — Refinance Later

Your first mortgage doesn’t have to be your last.

As your equity grows or market conditions change, refinancing can reduce your payment or help you pay off your loan sooner.

VA buyers may also qualify for a Streamlined IRRRL refinance, which often requires no appraisal and minimal documentation.

The goal isn’t perfect timing—it’s getting started and adjusting as opportunities appear.

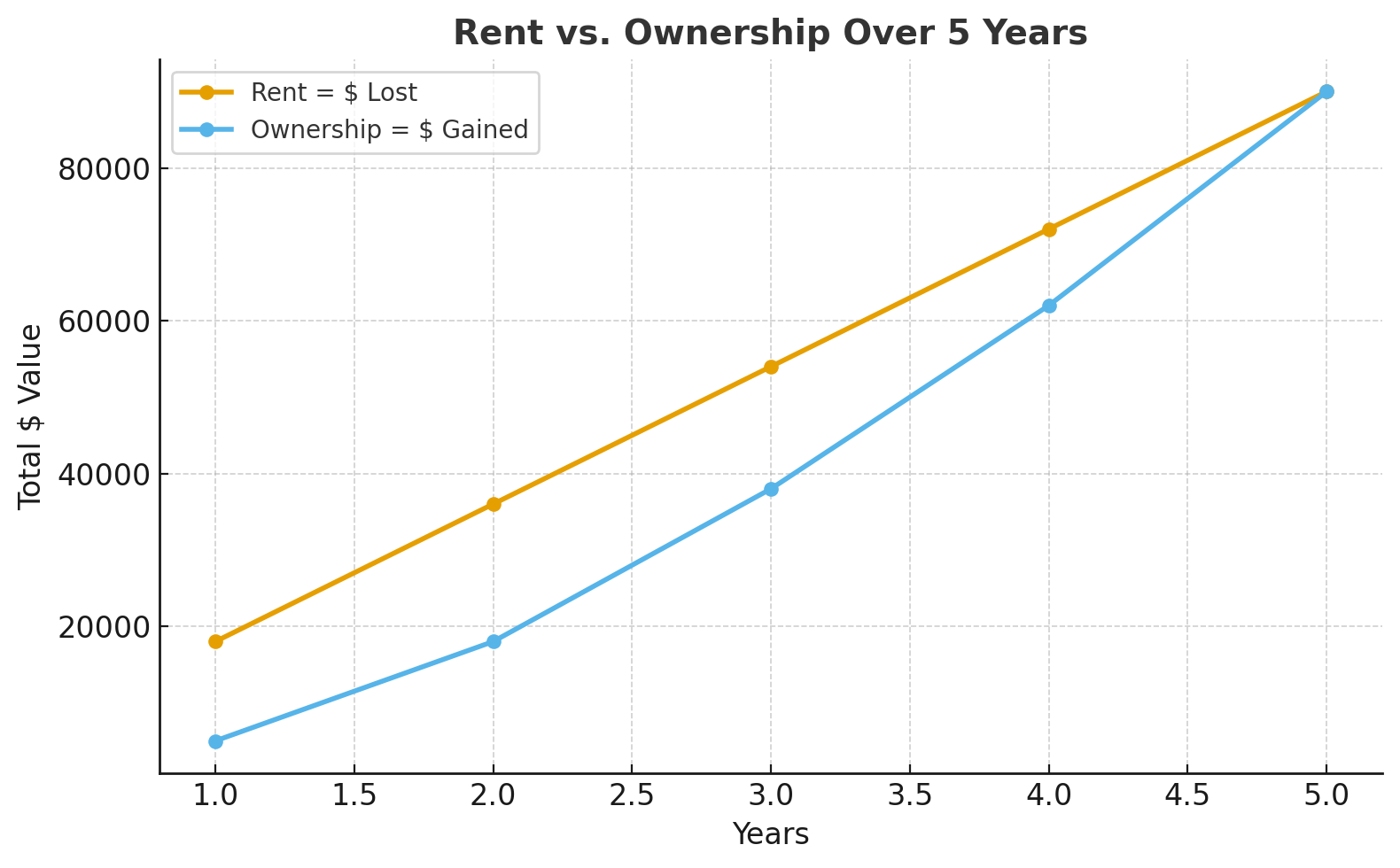

Why Buying Often Beats Renting in North Texas

Equity Growth: Each mortgage payment builds ownership. Rent does not.

Appreciation: Home values in

Collin County have historically trended upward.

Credit Strength: Consistent mortgage payments help build long-term credit health.

Wealth & Legacy: Equity can support future goals—education, renovations, or generational planning.

Put simply:

Every year of renting is money spent.

Every year of owning is money working for you.

Over five years, a renter might spend $90,000 with no return, while a homeowner could gain $90,000 through equity and appreciation.

Collin County Snapshot: A Market with Momentum

Inventory: Up slightly—giving buyers more choices.

Prices: Average home values hover in the

$400Ks–$500Ks depending on city and condition.

Market Strength: McKinney, TX was recently ranked #1 in the nation for real estate performance in WalletHub’s 2025 Best Real Estate Markets study, which analyzed more than 300 U.S. cities on market strength, housing trends, and local economic indicators (WalletHub, 2025).

The North Texas housing engine is humming along—steady, strong, and full of opportunity.

Your Path to “Keys in Hand”

Step 1: Get Pre-Qualified

See what you can afford and which programs fit best.

Step 2: Pick Your Loan

FHA (3.5%), VA (0%), USDA (0%), or Conventional (3%)—each with unique strengths.

Step 3: Layer Assistance

Ask about TSAHC and other Texas DPA options for added savings.

Step 4: Shop Smart

Focus on resale value, neighborhood growth, and your lifestyle goals.

Step 5: Refinance Later

When rates drop or equity grows, you can optimize.

Let’s match you with the right lender, the right plan, and the right home—here in the heart of North Texas.

📞

Call or Text:

469-499-7452

📧 Email: cindycoggins@kw.com

Sources:

- WalletHub. 2025’s Best Real Estate Markets. Retrieved October 2025, from https://wallethub.com/edu/best-real-estate-markets/14889