Before You Ever Tour a Home—The Buyer’s Reality Check Series

Pre-Search Phase

Buyer stress usually starts before the first showing—not during it. Unclear finances, outside opinions, and pressure to “keep up” create urgency without direction. That’s when buyers either rush decisions or freeze entirely.

Jumping straight to listings often makes this worse. Price filters set expectations too early, emotions attach quickly, and choices start forming before limits are defined.

Lender approval is not affordability.

What matters is a monthly payment that still feels comfortable after moving costs, utilities, maintenance, and daily life settle in. Buyers should also plan for post-closing reserves and longer-term financial goals before setting a price range.

Before touring homes, buyers should define:

- Non-negotiables (what truly matters)

- Flex areas (where compromise is acceptable)

- Time horizon (short-term vs. long-term ownership)

These guardrails prevent emotional overreach and wasted time.

Market noise adds pressure but rarely clarity. Headlines and advice don’t reflect personal readiness—and life circumstances matter more than market chatter.

Starting with financial comfort and clear priorities creates confidence before emotions enter the process. That foundation reduces stress, limits second-guessing, and supports better decisions at every step.

The Tools That Create Pre-Search Clarity

The pre-search phase isn’t about browsing homes—it’s about setting boundaries before emotions enter the process. The three tools below are designed to be used together, in order, to establish financial comfort, decision priorities, and readiness to tour. Skipping steps often leads to stress, wasted time, or second-guessing later.

Use them once at the start of your search—and revisit them if your situation changes.

HOW TO USE THESE TOGETHER:

1️⃣ Complete

Financial Reality Worksheet

2️⃣ Define priorities with

Decision Matrix

3️⃣ Confirm readiness using

Tour Readiness Gate

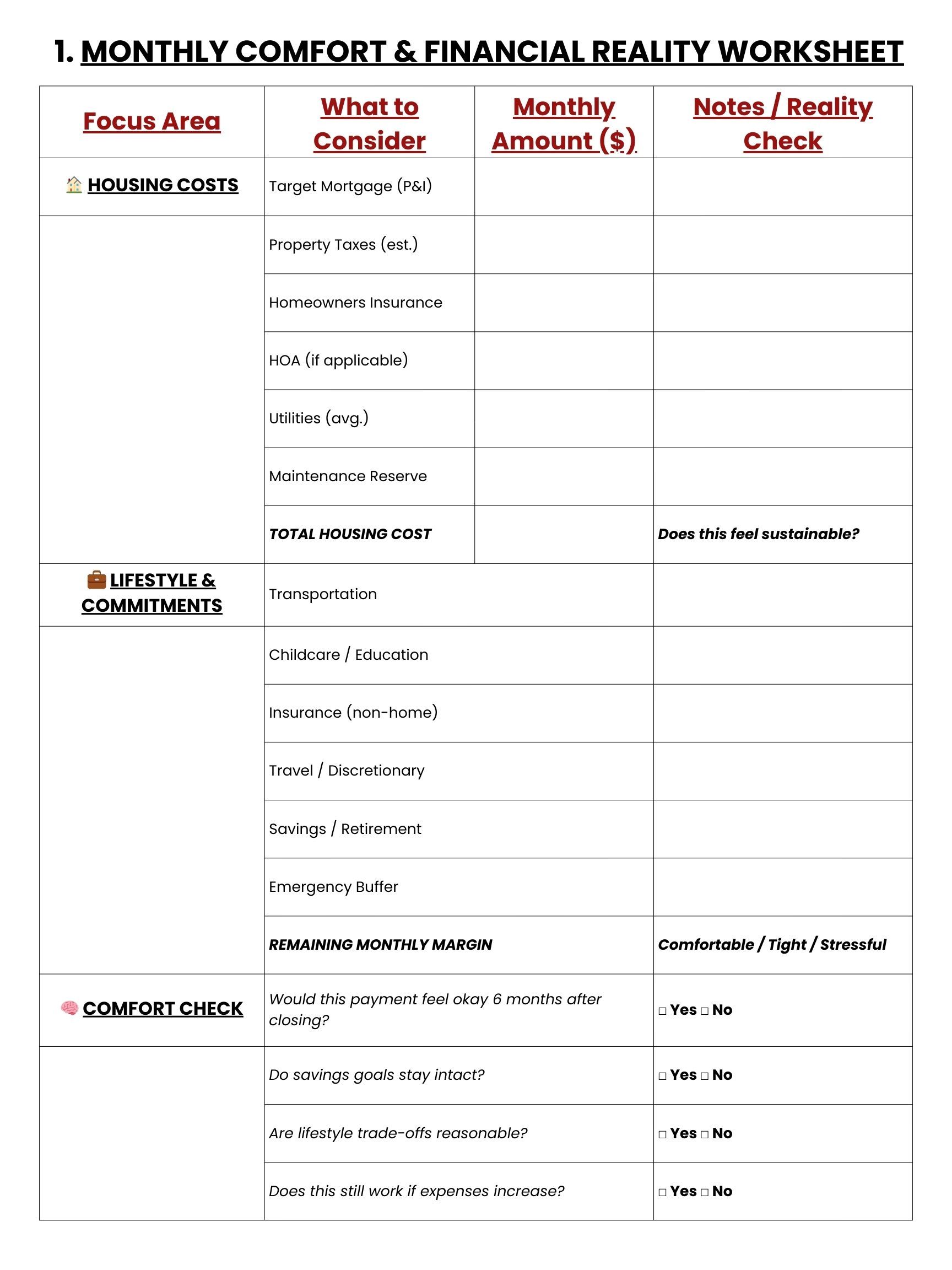

What this is:

A practical tool to determine a

comfortable monthly housing payment, not just what a lender approves.

How to use it:

List your estimated housing costs, lifestyle expenses, and savings goals to see what truly fits your budget after closing—not just on paper, but in real life.

Why it matters:

This helps prevent financial stress, overbuying, and regret by aligning your home payment with your long-term comfort.

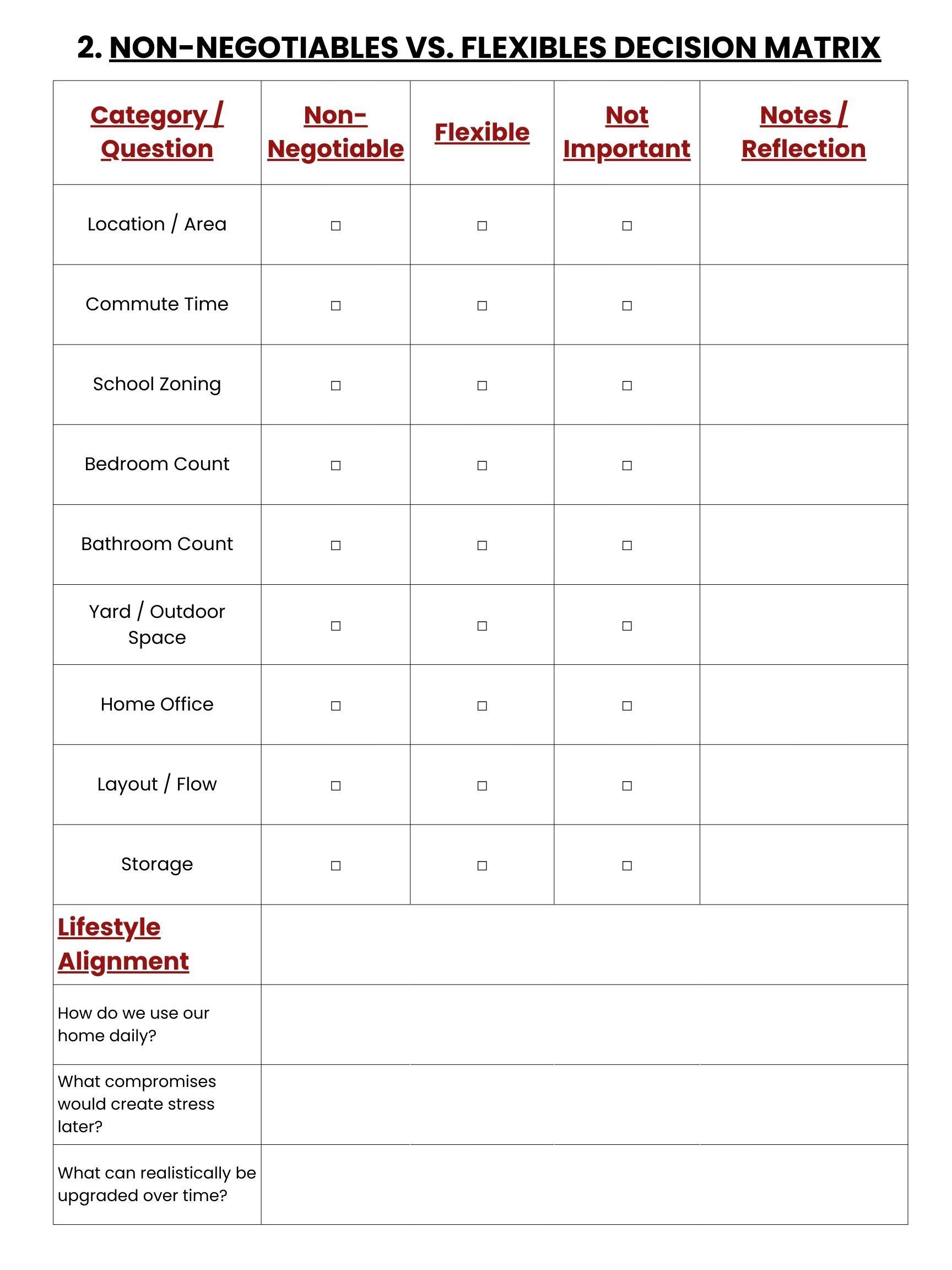

What this is:

A decision-clarity tool that helps you define what truly matters in a home—and what you can compromise on.

How to use it:

Before touring homes, categorize features as

must-have,

flexible, or

not important so emotions don’t override priorities later.

Why it matters:

Clear priorities reduce decision fatigue, speed up the search, and help you recognize the right home when you see it.

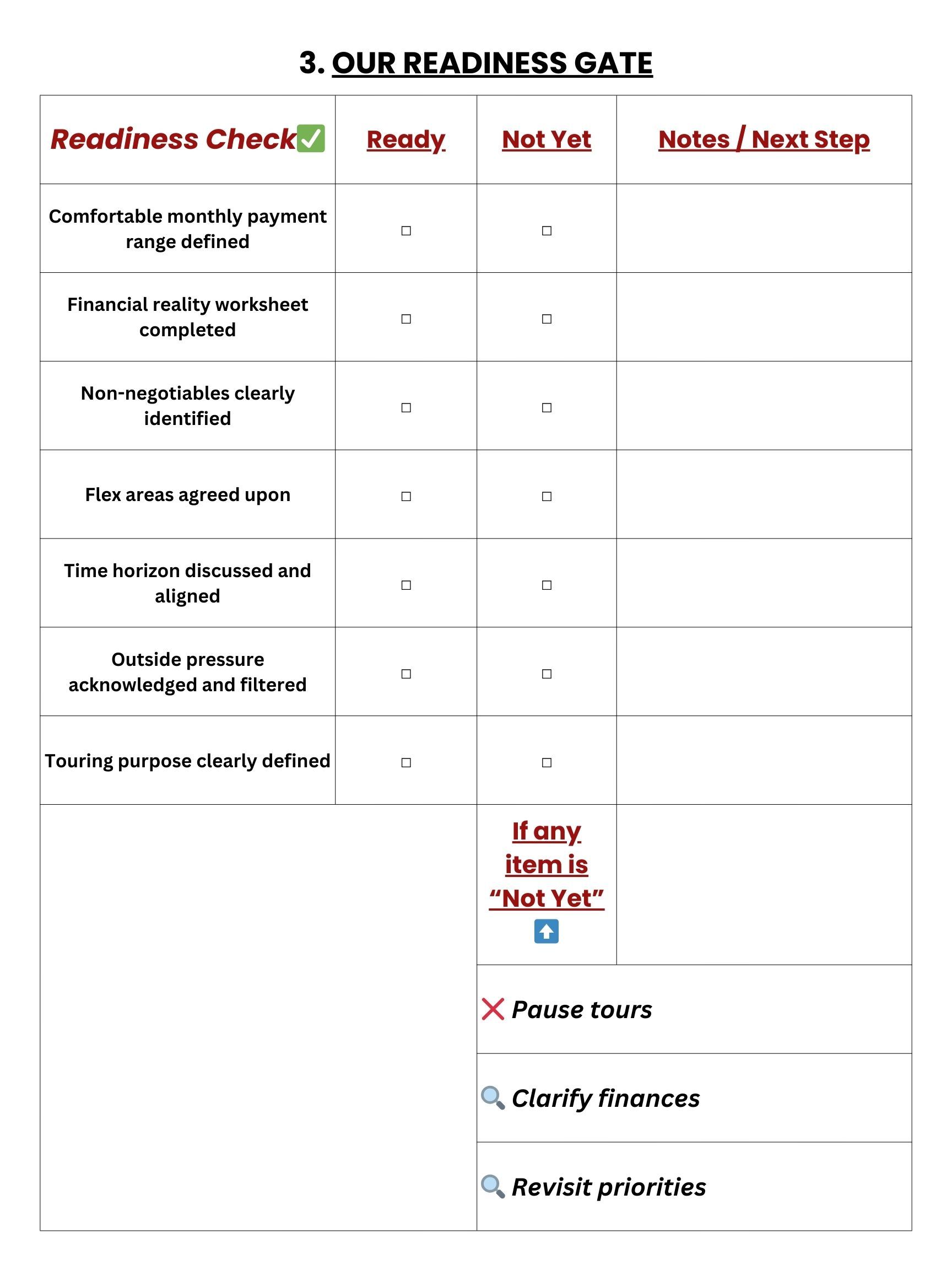

What this is:

A quick pre-tour checklist to confirm you’re ready to start viewing homes with confidence.

How to use it:

Complete this checklist before scheduling showings to ensure finances, priorities, and expectations are aligned.

Why it matters:

Touring before you’re ready often leads to burnout or emotional attachment too early. This keeps the process focused and productive.

Continue the Buyer Journey

Previously:

➡️Overview

Next:

Once the search begins, decision fatigue can build quickly without structure. The next post covers how to house hunt efficiently without burning out.

Making Informed Buying Decisions Across

North Texas & DFW

If you’re planning to buy a home in Plano, Prosper, or Celina, or anywhere across North Texas and the DFW area, Cindy Coggins Realty Group can help you evaluate your options and understand how local market conditions affect your decisions. When you’re ready, reach out to start a conversation and move forward with confidence.

Message Cindy to receive your complete copy and buy with clarity instead of guesswork.

📞 Call or Text: (469) 499-7452

📧 Email:

cindycoggins@kw.com